KEYS: At the center of multiple secular tailwinds

Keysight Technologies has many of the makings of a high-quality compounder. The company has excellent economics, a combination of powerful competitive moats, a conservatively financed balance sheet and ample opportunities to re-invest in the business both organically and inorganically at high rates of return. I may even go so far as to say that KEYS might perfectly fit Phil Fishers original checklist.

Currently, the company’s end markets are experiencing a cyclical drawdown which is hurting revenue. Bears are correctly pointing out that we have likely not seen the bottom of activity in these end markets. Some are noting that the long dated secular tailwinds, particularly around 5g, may be abating. While there is credence to these arguments, I believe that the near-term cycle is closer to the end phase than many believe, the secular growth drivers are more than intact, and may be strengthening as compressing innovation cycles increases the need for electronic test and measurement capabilities. In fact, my contention is that Keysight has already shown an ability to out compete and execute versus a fragmented competitor base and is likely to emerge from this cycle in an even stronger position. Strangely, for being a company that has touched almost every advanced product we interact with in our daily lives, few people seem to know of the company. Even more attractive, I have been surprised how few buyside investors outside of technology specialties have studied the company.

Section 1: An explanation of what KEYS is and its history

Section 2: Analysis of KEYS moat

Section 3: A brief overview of KEYS economics

Section 4: Segment breakdown and secular drivers

Section 5: Comments on management, the balance sheet and capital allocation.

Section 6: A mental model for valuation

This is not investment advice. Investing is dangerous, often painful, and possibly hazardous to both your financial and mental health. Do your own homework.

Section 1: An explanation of what KEYS is and its history

Keysight Technologies came public in November 2014 but its history goes back much further. The business was developed inside Hewlett Packard in the late 1930’s as one of the first electronic test and measurement companies. In fact, what would become Keysight today can trace its roots to before the founding of Silicon Valley and today their semi-conductor fab sits just north of San Francisco. Like many of the more advanced scientific companies of its day, its operations were particularly focused on defense applications, a market that still plays an important role for the company today. Interestingly, whereas defense application drove science advancement from the 1930’s-1990’s, the modern era is defined by commercial advancement driving the R&D that flows back into advanced defense applications.

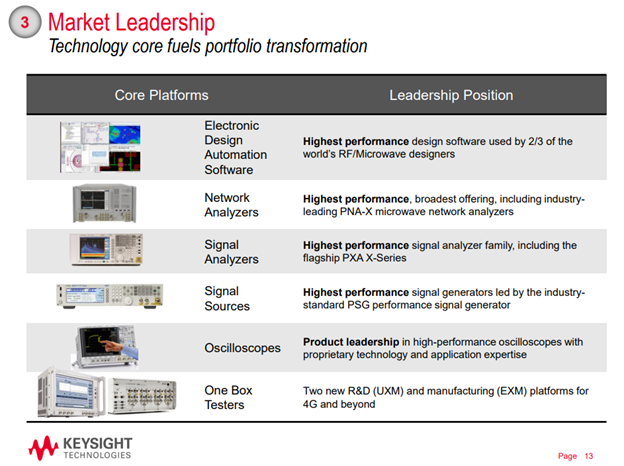

The best way to think about the company is that it provides hardware and software for electronic testing and measurement that is vital to the research and development of a wide range of electronics applications and quality control once a product enters mass manufacturing. It is not simply the box of hardware that is important, but rather how the sensors (analog semiconductors) interact with the custom software that is inside each physical device. Today, almost 70% of Keysight R&D talent is software focused and it is helpful to think about their hardware as being a monetization model for their silicon and software capabilities. Moreover, they also have a traditional software business that is sold on both licensed and SaaS basis, not to mention a highly profitable service organization that helps implement and maintain all the advanced equipment in the field. On the pure software side, KEYS dominates the EDA (electronic design automation) space for RF (Radio Frequency), but their software is increasingly becoming important in scientific and product workflow solutions that are at the heart of a wide range of electronics life cycles.

Many investors struggle to understand Keysight because their product portfolio serves a diverse end market and is both vast and very technical.

The best analogy I can give is to think of them as the ThermoFisher of electronic space. They build the tools and software that allow research and design teams to advance their work on the front end and on the back end they have products that monitor/enable the production. Below is a screenshot of all they offer but I recommend going to this link to see the diversity of their product portfolio.

https://www.keysight.com/us/en/products.htmlhttps://www.keysight.com/us/en/products.html

Former CEO Ron Nersesian would crystalize what Keysight is and how this vast suite of products relates to the customer when talking to investors: “So why do [customers] come to us? What is unique about Keysight? And this is something that is sometimes misunderstood because it’s a pretty complex business. And it all comes down to one simple statement: we help customers bring breakthrough electronic products to market faster at a lower cost." -2015 Analyst Day

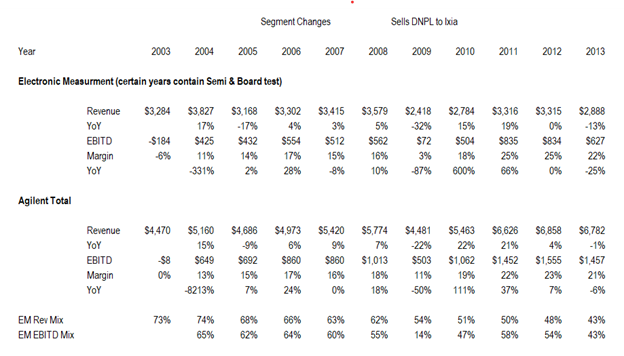

HP would eventually spin Agilent Technologies in the late 90’s and what is Keysight today was reported under the Electronic Measurement Division. As you will see below, despite being the largest part of Agilent’s business post spin, this segment was a bit of an albatross around management’s neck. Electronic Measurement was more volatile than the Life Sciences division, did not have the same consumables mix and had a lower margin. Making matters worse, Electronic Measurement at the time was much more exposed to commodity parts of semiconductor testing and general manufacturing that followed the cyclicality of their end markets and had a much more competitive peer set that hampered margins. The combination of these attributes rightly caused the then Agilent management to starve the segment of capital (both R&D investments and M&A) as they re-invested more heavily into the Life Sciences business that many investors fawn over today. As time wore on, post the Great Financial Crisis, the lack of investment would lead to competitive gaps with peers that Keysight would later rectify through M&A.

Perhaps it is no surprise that Agilent was so eager to spin the business. In November 2014 KEYS came public. The stock traded quite poorly for the first two years as the company continued to struggle to ignite growth or inflect margins.

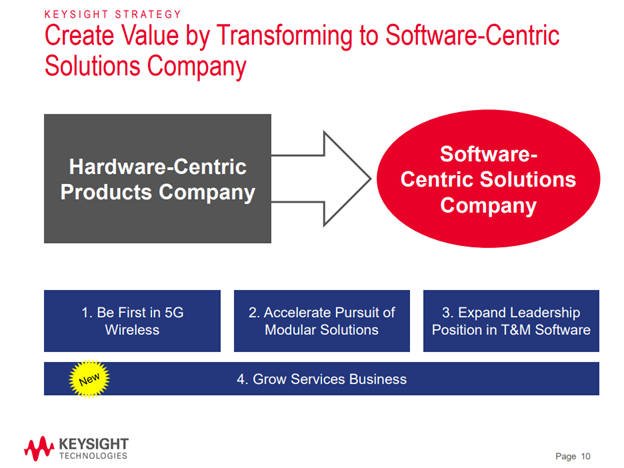

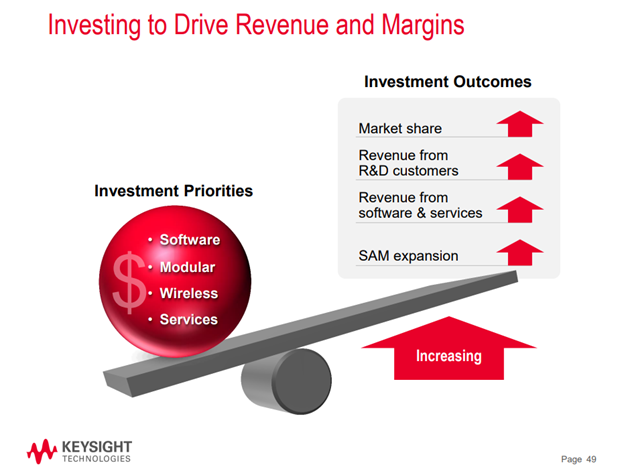

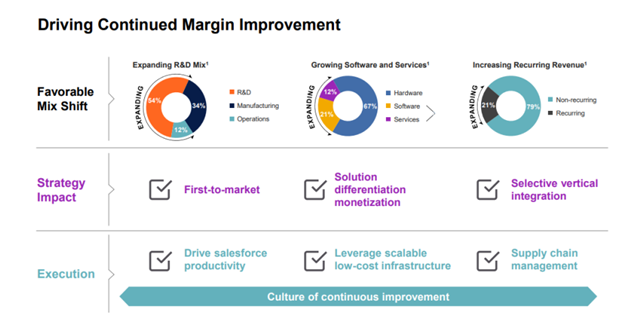

Importantly though, then CEO Nersesian and his management team would lay the groundwork for the strategy of re-invigorating the internal research pipeline (increase spend from the LDD to the mid-teens), shifting the focus of the business towards R&D end markets vs. manufacturing, and lay the groundwork to become more of a software & services centric company. The basics of this strategy are still intact today as KEYS continues to move up the value chain by investing more gross profit dollars into R&D and more discretionary free cash flow into software M&A.

2015 would turn out to be the turning point for KEYS. They would buy Anite that year to add to their software capabilities in the communication markets in front of the coming 5g wave and would buy Ixia in 2017 to bolster their network visibility portfolio in front of the massive data center build outs by the hyper scalers. Combined with better innovation off increasing R&D spend, winning market share as 5g research accelerated, re-organizing sales teams around the customer, and a focus on services, KEYS would finally ignite their organic growth profile and substantially improve their software mix, gross margins and EBITDA margins.

Section 2: Analysis of KEYS moat.

Ron and his team deserve a lot of credit for refocusing Keysight after spinning off from Agilent and executing a playbook that was geared towards building and expanding on the companies’ advantages. Those advantages have only grown since then and form an interlocking moat that is difficult to see others having the resources or the desire to penetrate.

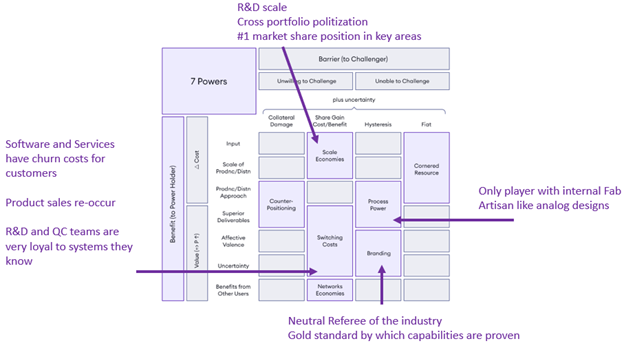

Helmer’s 7 Powers framework is a helpful tool to understand the strength of Keysight’s moat.

Process Power:

It is rare to call a building a competitive advantage, but Keysight’s High-Frequency Technology Center in Santa Rosa is crucial to the company’s edge. Unlike the rest of the peer set that buys merchant silicon, KEYS has their own in-house semiconductor fab located in the building. This is not like a Texas Instruments 300mm scaled facility with a clean room of 275k sq feet, but rather a smaller <20k sq fab, optimized for experimentation not throughput, that is focused on specifically designed chips that marry Keysight hardware to their software. Like other high value analog engineers, the staff here is closer to an artisan than a technician, tinkering with designs to build custom capabilities that are requested by the field.

“Several years ago, the engineers at our central research labs developed a new family of chips. They're very advanced analog chips, performance leaders, specification leaders in what they can achieve. Those chips are fabbed at our in-house captive facility in California. Why is that important? In contrast to a merchant fab, our in-house fab has been purpose-built and optimized over the years to meet the needs of test and measurement circuits and test and measurement circuits alone. A merchant fab has to serve many customers with a wide variety of end applications and invariably has to compromise some of the many performance parameters in order to make a best fit across all of those end applications.

So we've taken these very advanced circuits that are manufactured in a purpose-built fab. We deployed them into the benchtop form factor. The result was a market-leading, a benchtop signal analyzer. We also deployed those chips into the modular form factor and achieved a breakthrough network analyzer that fits on a single PXI module slot." -Jay Alexander (CTO) 2015 Analyst day

It is telling that only 2% of Keysight’s integrated circuits comes from their internal fab, but it is these chips that are some of the largest sources of differentiation versus their competitors. A great example is the high-end Oscilloscope market, where they have quickly gone from the #3 player to the industry leader, with no competitive response from any player despite the product being in the market for years. Where the average high-end Oscilloscope might cost in the low tens of thousands of dollars, Keysights UXR series starts at $200k with some models costing upwards of $1M. The premium earned on these boxes has everything to do with chips that are inside and how they are married to Keysights custom software.

Scale Advantage:

Keysight is the largest player in the industry by almost every measure. The company highlights the fact that they are #1 in almost every major market that they operate in, often having 20-30% market share. Frankly, this might underestimate their position as often they are nearly the entire market in the most advanced applications.

Keysight’s annual R&D spend is larger than all but one of their competitors’ revenue.

Apart from the sheer size advantage of this spend is how Keysight can cross pollinate their scientific break throughs. The quote above from the then CTO at the 2015 analyst day applies here as well. Many of their peers are smaller and more focused on siloed technologies and applications and they must spend relatively aggressively in making both scientific and marketing advancements. At times this means Keysight’s competitors also must make highly customized solutions for specific customers that they cannot apply to other markets where they lack the channel scale or reputation. Keysight, on the other hand, can attack some of these medium sized opportunities with little need for massive customization and still can leverage the scientific, IC and software breakthroughs to attack multiple other niche markets that their siloed competitor don’t have the scale or customer loyalty to access.

Keysight’s dominant position with some of the largest players in every industry is enviable. It is also important to realize that their average customer spend with KEYS is well under $1M per annum and no single customer is 10% of revenue. This speaks to the long the tail of customers in their diverse end markets.

Switching Costs & Tight Customer Integration:

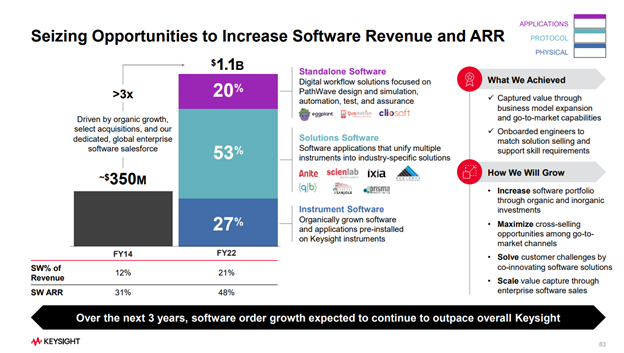

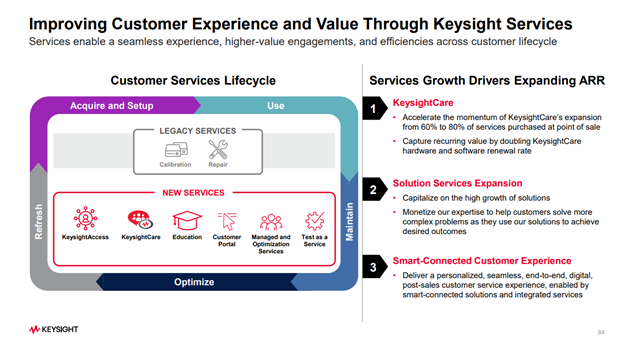

An underappreciated aspect of the Keysight go to market model is how much of their revenue is either pure software or ongoing services contracts. While they do not break out the numbers formally, slightly better than a 1/3 of their revenue mix is contractually recurring and is predominantly focused on R&D end markets that tend to be more (but not completely) insulated from macro-economic shocks. Through both a combination of natural growth and M&A I believe that KEYS can drive the software and service mix greater than 40% of revenue by the end of the decade.

The most recognizable switching cost advantages are in their pure software offerings that exited FY 2023 at roughly $1.3B in revenue and have been growing ARR organically at a consistent high-single-digit rate over the last few years. Like their equipment product set, Keysight’s software offers a diverse set of capabilities that enables the design, automation and test of physical capability, protocols, and the application layer. For simplicity’s sake, think about the protocol layer as the instruction sets for how things are done in the background and the application layer as what one would interact with.

Roughly $300M+ of Keysight’s revenue is from their EDA (electronic design automation) suite that dominates the RF and microwave markets with roughly 80% share. The easiest way to think about this business is that it is very similar to Synopsys and Cadence Design Systems, but with very little competitive overlap as those two behemoths specialize in digital end markets. Their dominant share comes from decades of inroads with RF and Microwave engineers, many of which have honed their craft on KEYS software during their apprenticeship and is further bolstered by the fact that the design software integrates well with much of the other equipment that KEYS offers.

The other large chunk on KEYS SaaS business is a platform called Pathwave. In the broadest sense, Pathwave is a workflow solution suite that links the design, measurement, and test data across the lifecycle of a product. It is rare that a single physical test instrument is used in the R&D of an advanced electrical product. Pathwave allows the R&D teams to link the data from multiple Keysight products so that the scientist can design the appropriate measurements, the engineers can carry forward that data into production and on the back end the manufacturing teams can cross reference quality control data to make sure the products are doing what they were designed to do. With KEYS touching so many different parts of the design to production lifecycle this software platform is becoming increasingly important for customers to achieve their go to market efficiency goals.

The remaining 10% of revenue that is contractually recurring is the maintenance and servicing contracts Keysight has on the field deployed equipment. Today there may be upwards of $45B of deployed Keysight equipment around the world that needs servicing. When KEYS sells a physical piece of hardware there is a growing attach rate for a service contract where KEYS takes on the responsibility of maintaining the in-field gear. This includes calibration and basic maintenance. Importantly, these contracts come with very high gross margins, and customers have realized that they do not want to maintain their equipment themselves (which means a heavy capex investment in calibration tooling) nor do they want to outsource the service…especially when the customer is usually interested in the total solution package that requires KEYS products to integrate with multiple parts of the value chain.

While these contractually recurring pieces of business come with the switching cost moats of traditional Software/Service, it is also important to realize that the majority of Keysight’s more discrete product sales re-occur at a very high rate. From various interviews with reps, I have heard that over 95% of customers who have spent at least $100k with Keysight return within at least 5 years with an order of at least that size.

The loyalty is in part due to technological advantages, but there is also an institutional imperative advantage that favors Keysight. If anyone has been around academic or scientific circles this will not be surprising. There is often resistance in R&D departments to change workflow solutions without significant benefits as the costs to retrain labor, let alone ensure backwards and forwards compatibility, is burdensome.

Keysight makes it a priority to be ‘first’ to market with the appropriate solutions and their tight integration with the end customers often allows them to see deep down into their customer pipelines, forming a unique partnership. Keysight’s direct salesforce, the largest in the industry and responsible for ~75% of Keysight accounts, is a unique advantage as well. This channel often sees the end R&D customer pulling the sale through collaboration with the Keysight R&D team, instead of a more strategic push on convincing a CFO to sign off on a project. It helps that Keysights products are typically a very small fraction of the budget but are critical to most of their customers’ scientific or manufacturing needs.

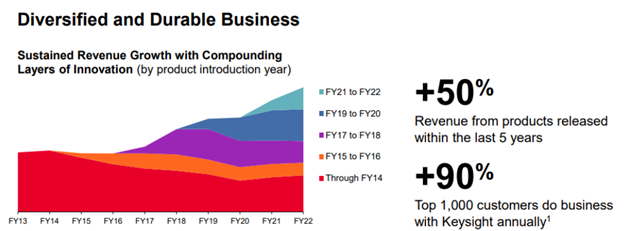

The combination of tight integration with the end customer that is focused innovation, providing a vital service that is low cost in relation to the end customer goal, and re-occurring nature of much of the product suite creates a beautiful layer cake effect on revenue.

Branding:

If there is an area I expect people to take umbrage with it is the idea that Keysight has any sort of branding moat. Afterall, they have almost no consumer presence (despite touching nearly every advanced electrical product in our daily lives) and Keysight is barely known outside of the scientific community.

That said, talking to various engineers in the industry, especially those involved in their key verticals, it becomes apparent that Keysight is the gold standard in the industry…particularly in western markets, in R&D labs and scientific communities. Part of this is due to a 75-year history in the business, where they have become a trusted partner for so many of their end customers. It is also due to Keysight’s steering of industry standards. Their personnel sit on 30 of the most important standards bodies, which gives them a unique insight into where technological development is heading and what solutions need to be brought to bear. In many ways, Keysights position allows them to act as a neutral referee as component manufacturers compete to prove what products are best.

If you ever want to see Keysight’s branding power in action, just show up a day or two early to any advanced electronics trade show. The distribution of Keysight equipment to various vendor booths is one of the more intense periods for those setting up the show. Every vendor nervously waits for their Keysight equipment to arrive onsite to prove that their electronic products can deliver on what is advertised.

Last point on this, it has been extremely helpful to watch a wide range of YouTube videos on all the technology that Keysight brings to bear. It is telling that Keysight Labs’s corporate channel has 113k subscribers, versus 23.5k from National Instruments and sub <5k for basically every other player in the space. Seriously, if you want to see some nerd’s geek out on tech its worth going over to Keysight’s YouTube channel (no offense to nerds…I am one).

https://www.youtube.com/@KeysightLabsSection 3: A brief overview of KEYS economics.

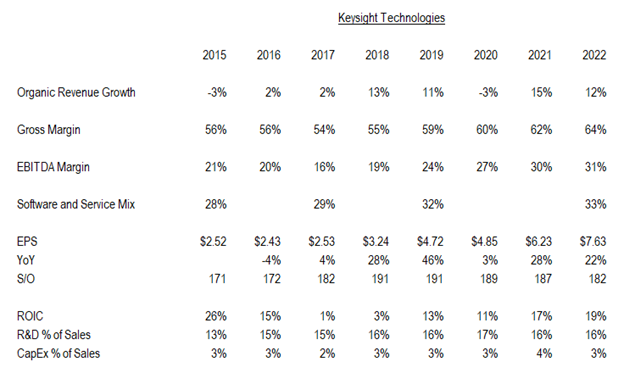

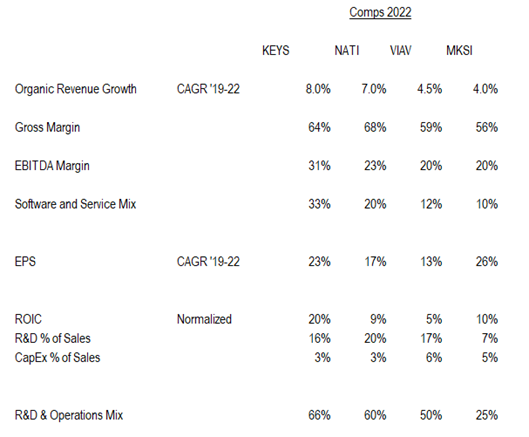

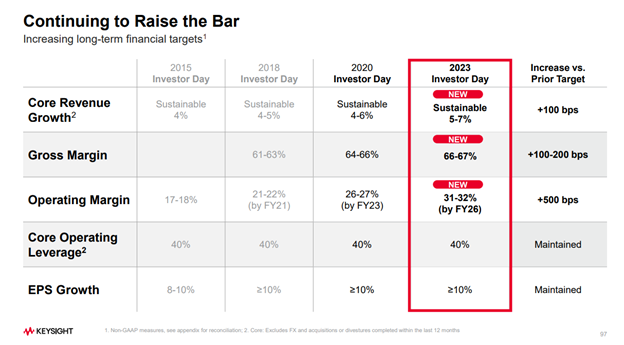

There are few things more satisfying to an investment analyst than being able to clearly see an attractive economic profile. Versus most of their peers, Keysight has some of the best organic growth rates, the highest margins, the best software and service mix, least amount of capital intensity and highest returns on capital.

Talking to industry insiders there is actually very little direct overlap between Keysight and their public comps. NATI is a competitor in the communications market but has largely fallen behind in 5g technology. Note that NATI is the only true direct competitor and was recently acquired by Emerson for ~5x Revenue and 21x EBITDA. Anritsu (6754 JT) does compete heavily in the manufacturing side of the communications market but does not have the same presence in R&D and has revenues that are 1/7th the size of Keysight. The manufacturing exposure for Anritsu was evident in the previous quarter where Anritsu’s orders fell 28% while KEYS orders only fell 15%. Viavi does come up as a comp but their test and measurement business is only a few hundred million dollars and MKSI’s semiconductor test business is likely less than $100M at this point.

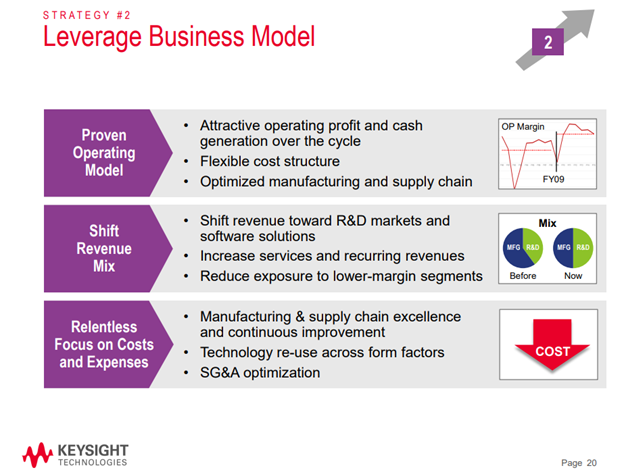

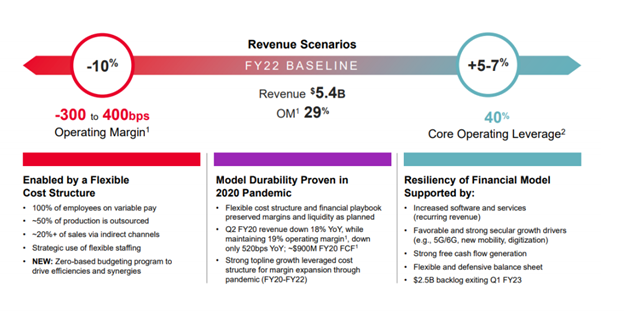

Perhaps most importantly, the economic model for Keysight is highly adaptable. As KEYS has integrated deeper into R&D and operational processes of their customers and the software and service mix has grown, Keysight has dramatically improved their revenue and profit resilience. In R&D applications you often see less volatility as the business is more closely tied to design starts and experimentation, rather than the volume of widgets leaving the factory. Customers who are focused on being state of the art typically will continue to invest in these areas during a downcycle to ensure they are participating in the business when the cycle turns, leading to a less volatile volume dynamic than the manufacturing areas of the business. Moreover, the rate of scientific advancement seems to be accelerating, which keeps the pressure on R&D teams to deliver.

Over time, the growing mix of software through both organic and inorganic growth should continue to bolster this margin profile. KEYS has clearly prioritized software as an area for M&A. Moreover, this has been the most resilient part of their growth profile but has been masked by the massive demand for equipment during the last four years. By my estimates, the combination of continued growth in their current software offering and the recent ESI acquisition should push the software sales close to $1.5B in revenue and a mid-20% mix next year. The flow through margins on this part of Keysights business should look very healthy:

“As far as software margins, it’s close to 95%. Depends how much support there is, you take support, it’s – if you put support cost in your overall cost of sales as opposed to putting them down in the G&A line, like you do on other R&D, positioning up there. We’re seeing 85% margins. An you can see our overall gross margin hit an all-time high where when we started the company, it was in the 56%, 57% range and now we’re at 65%." -Ron Nersesian 2020 Analyst Day

Equally important, it is important to realize that Keysight’s value add really comes from their IP and engineering teams. In fact, the production of their physical equipment is largely outsourced (~50%) with Keysight being the final assembler. This helps to avoid the capacity utilization issues that naturally come from cyclical end markets.

Finally, compensation from the top of the organization down to the front-line employees has a significant component that is largely variable and tied to broad company performance.

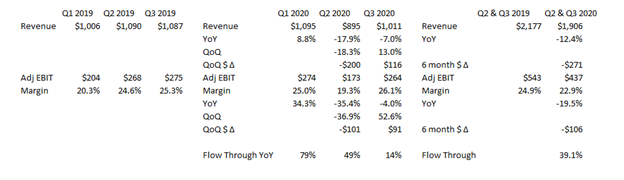

Putting this all together you get a businesses model with enviable incremental margins but enough flexibility to dent the decremental flow through when end market cyclicality occurs.

The first few months of Covid were very telling for the effectiveness of this design and stand in stark contrast to the Great Financial Crisis when margins were decimated. Despite a rapid drop in revenue, management was able to flex the cost structure quickly so that by the time they were exiting the period 6 months post covid margins had largely recovered.

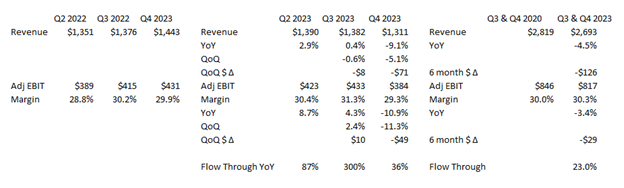

The last two quarters of 2023 show a similar ability to manage the decremental margins as the business goes through the start of cyclical drawdown in their EISG segment.

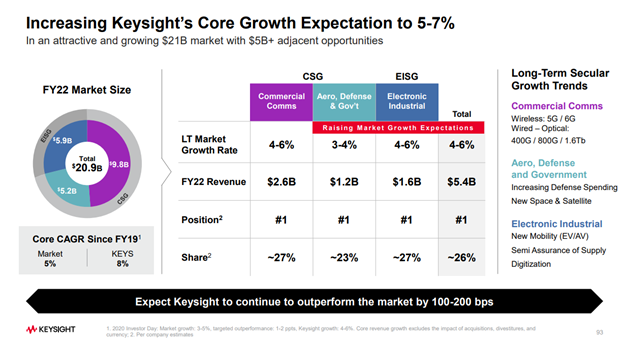

Section 4: Segment breakdown and secular drivers

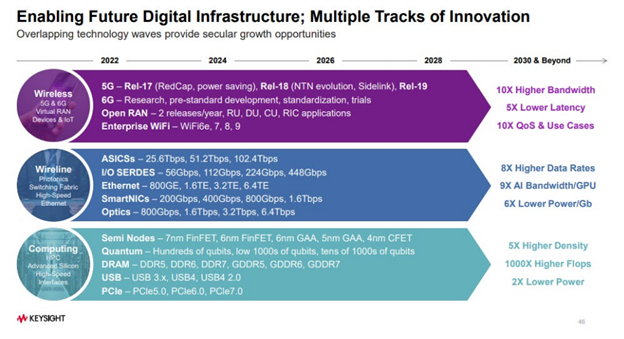

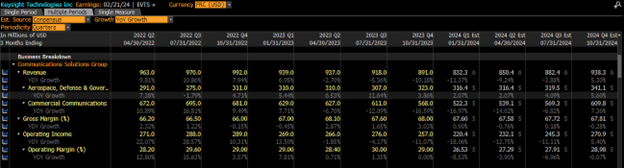

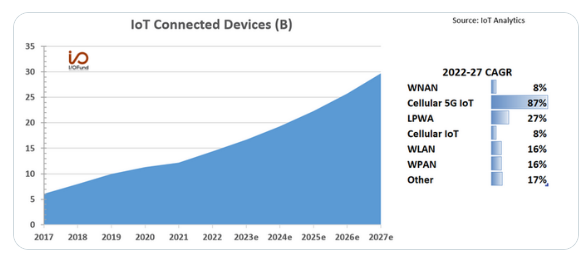

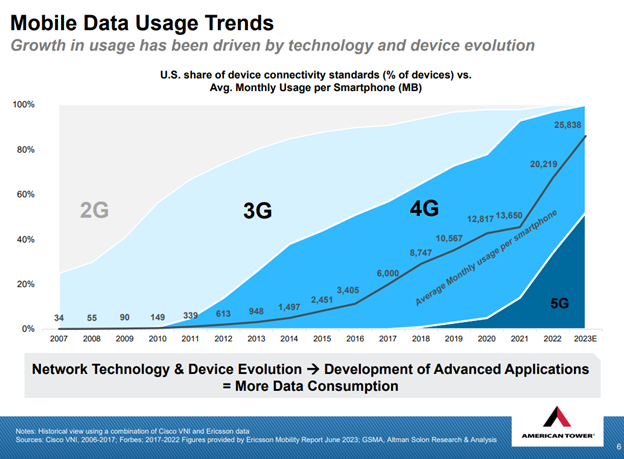

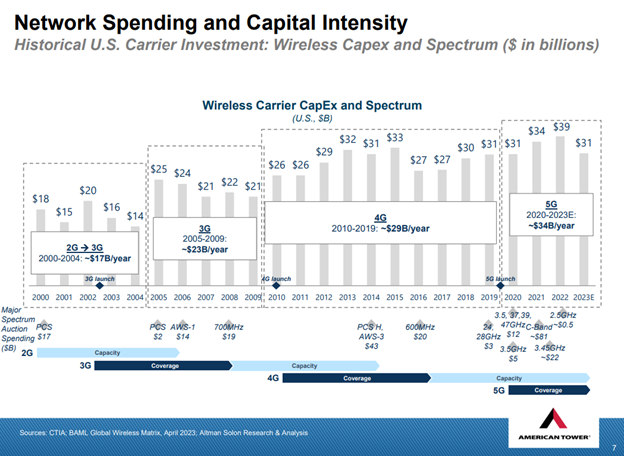

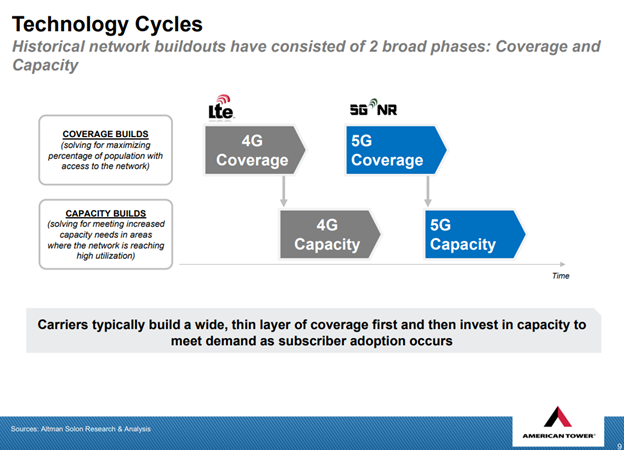

With such diverse end market exposures, it is helpful to breakdown KEYS segment reporting to better understand the fulcrum points that the street is debating. As we review below, my contention is that we are getting closer to a ‘base’ level of earnings with a few secular tailwinds to re-ignite starting later this year and into 2025. The key tailwinds for Keysight are centered around a long tail of 5g capacity build outs, a key position in networking that is among the bottlenecks in advanced computing, increasing semi-conductor content and complexity, and the general trend towards ‘smart’ devices.

CSG:

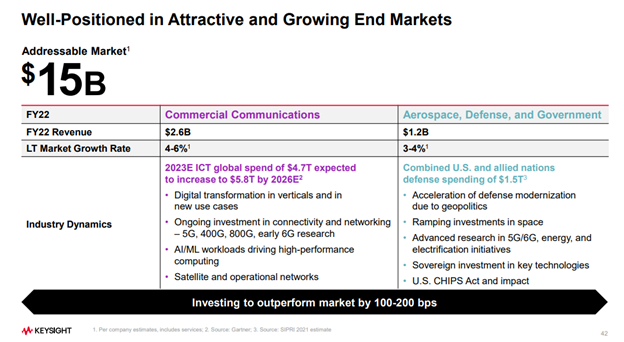

The Communications Solutions Group is the largest segment and the one where we see the heaviest levels of investment and generates 60% of Keysight’s revenue. It is further broken down into Aerospace, Defense and Government revenues and Commercial Communications.

While the two revenue groups have different end customers, the mix of business is closely aligned with an even split between wireline and wireless solutions. Importantly, this segment is the most heavily oriented towards R&D end markets. Traditionally this would be 70-75% of the mix mid-cycle but is likely closer to 80% of the current mix as the manufacturing revenue has cycled down dramatically.

Late in 2021 bulls were overly excited thinking these markets would never go through a cycle. Clearly drinking that Kool-Aid did not turn out well for them as the initial 5g spending wave slowed towards the end of 2022, shortly followed by the hyper-scalers shifting their data center spending plans as they grappled with investor pressure for cost discipline against a need for new architectures to compete in AI.

That said, in both wireless and wireline segments there are clear indications that this is simply a pause in activity. In fact, I would argue that almost every major digital transformation story we see, from advanced computing, AI, IoT, AR/VR and streaming media requires Keysight’s involvement. Importantly, almost all the most important players in each ecosystem are echoing this viewpoint.

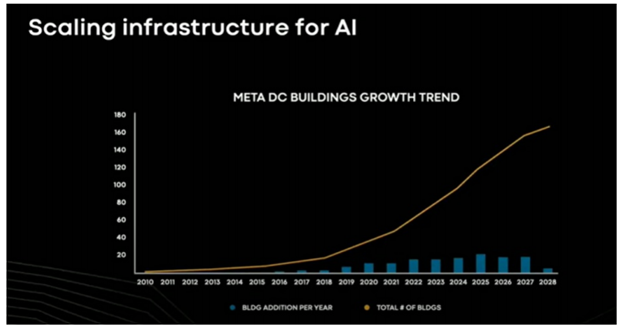

Advanced networking in the data center is a key example here. Commentary from hyperscale’s and network providers all point towards heavier datacenter and networking investments over the next cycle.

Ruth Porat GOOG CFO Oct 2023: “we are committed to meaningfully investing in capex given all the opportunities we see. We do continue to expect elevated levels of investment in our technical infrastructure…will continue to grow capex in 2024.”

Susan Li META CFO October 2023: “First, we expect higher infrastructure-related costs next year…with growth driven by investments in servers, including both non-AI and AI hardware and in data centers as we ramp up construction on sites with the new data center architecture we announced last year.”

https://www.youtube.com/watch?v=44t2-88GV3E&t=3251s

Amy Hood MSFT CFO October 2023: “We expect capital expenditures to increase sequentially on a dollar basis, driven by investments in our cloud and AI infrastructure.”

Brian Olsavsky AMZN CFO October 2023: “…increased infrastructure Capex to support growth of our AWS business, including additional investments related to generative AI and large language model efforts.”

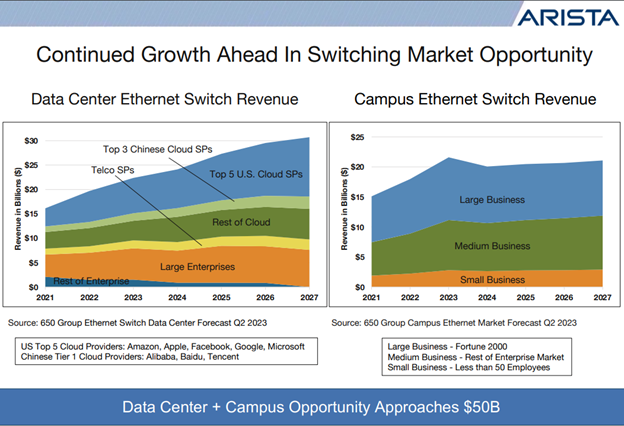

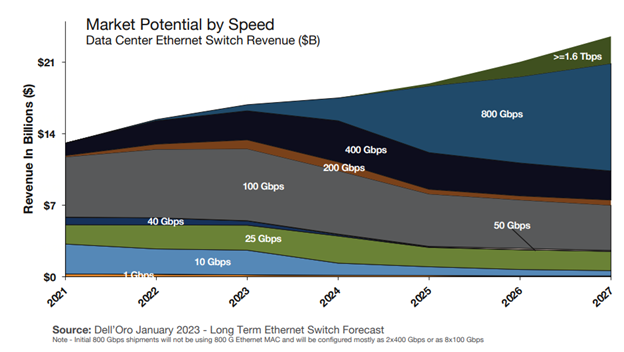

Alongside their heavy R&D mix in CSG, there is also a stronger mix of operational components that are deployed alongside the network build outs all the hyper scalers are referencing. This is on top of all the testing equipment that is put in place as the DC’s spin up. As hyper-scalers embrace 800gb+ in their front and back end deployments we should see an accelerating capex wave that requires Keysight equipment. Arista puts out some nice charts every quarter from the 650 Group and Dell’Oro that support this contention.

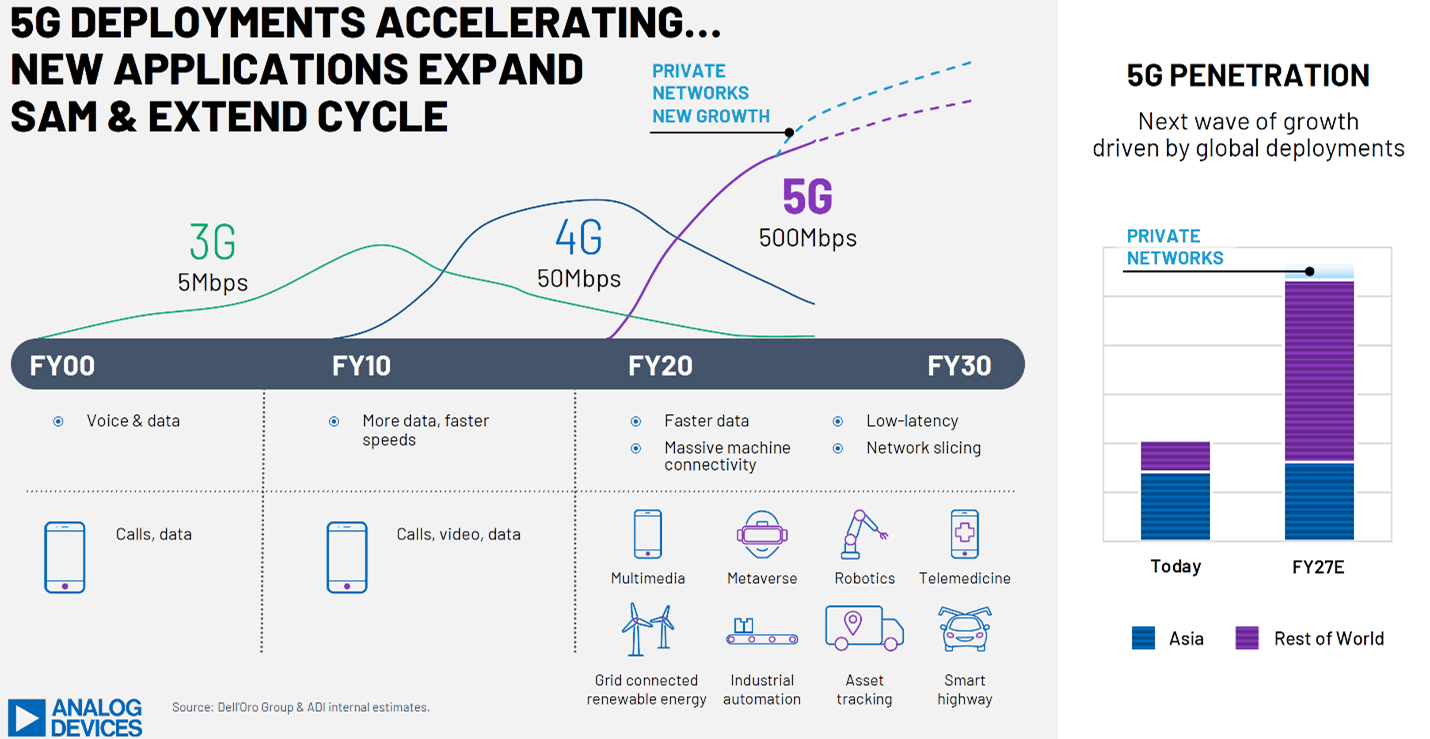

One of the more prominent bear cases on KEYS that I hear is that the 5g deployment cycle is over and that the wireless business is permanently dented. While there has certainly been a pullback in spend as the initial coverage phase of deployment was completed, almost every major player around 5g is signaling that this is a pause inside a longer-term uptrend that will blend between 5g & 6g and shift towards capacity build out. In fact, players like ADI talk quite optimistically about how much more meaningful the 5g deployment cycle can be versus prior Telco cycles, driven by IoT, industrial automation, private networks and accelerating multi-media use.

Equally important, it is important to note that a 1/3 of KEYS wireless revenues are still coming from 4g exposure. Even as the world shifts from prioritizing 5g coverage to 5g capacity there should still be years left of secular growth that will help build the layer cake of Keysight’s revenue. This is a view backed by key players like American Tower and Crown Castle.

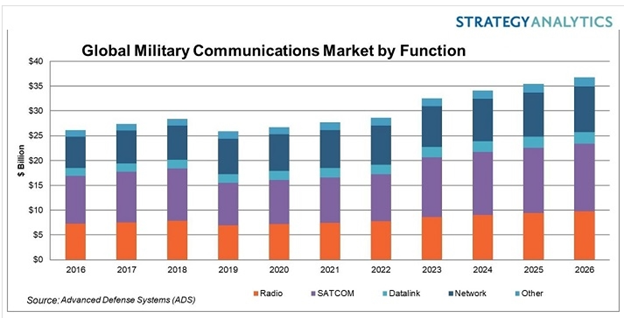

For Aerospace, Defense and Government revenues, militaries around the world are currently amid modernization of their communications networks that touch nearly every specialty market that KEYS serves. Making matters more complicated is the fact that we are seeing a balkanization of western and eastern technologies as western players move away from Chinese built components. I expect this to be a slow but steady growth market for a long time and gives credence to Keysights market forecasts.

EISG:

The Electronic Industrial Solutions Group is likely more associated with what investors think of as the classical test and measurement business that was inside Agilent. The segment is significantly more manufacturing focused (65%+) and is the area that really came under the pressure the last 6 months as semiconductor and general electronics related sales in Asia (particularly China) came under pressure. In fact, over the last 6 months I estimate that orders from China may be down 50%+, possibly suggesting we are getting closer to a bottom in orders over the next few quarters.

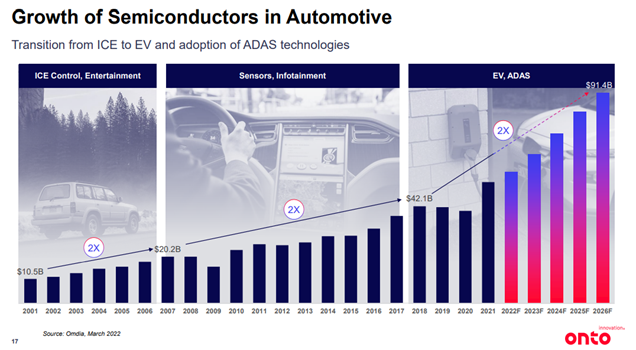

Roughly 40% of EISG’s revenue is directly related to semiconductors, with roughly 1/3 of that comprising operational components that are sold into lithography (can you even be in semiconductors and not have a product to sell to ASML). The remainder is manufacturing test equipment. The latter is among their most cyclical exposure as it is tied to fab expansion and changes in semiconductor production techniques. One must only look at the recent revenue results for most of the semiconductor capital equipment players to see why this business is under pressure. While this business is classically cyclical, like their semicap peers the long term trends are up and to the right. Over the medium term, government funding around the world should be a nice tailwind and I have yet to see any Keysight test and measurement equipment show up on any restricted lists.

General Electronics testing is another 1/3 of segment revenues and is nearly entirely manufacturing exposed. This side of the business is very tilted towards the Asia Pac region and follows general electronic production cycles. While not the most exciting area, as general consumer products are expected to become ‘smarter’ they will be packed with more electronics that should provide a tailwind. Frankly, I expect this to be the type of business that is lumpy, but when you zoom out it moves up and to the right. It is hard for me to imagine a world where per capita consumption of electronic devices goes down for any extended period.

Perhaps the most exciting area for EISG is their automotive exposure. This makes up the remaining 30% of revenue and is the only area inside the segment that is very R&D and design focused. This focus should only increase with the recent acquisition of ESI. ESI is best known for their crash simulation software, but they also play an important role in everything from chassis and acoustic design and have a meaningful business in Aerospace. The roughly $1B purchase price looks expensive at first blush for a business that should do $160M in revenue with 80% gross margins. That said, this is almost classic Keysight. ESI had limited reach into a number of customers that Keysight is already deeply involved with and the cross-sale opportunities should help to ignite what has been an anemic growth profile for ESI.

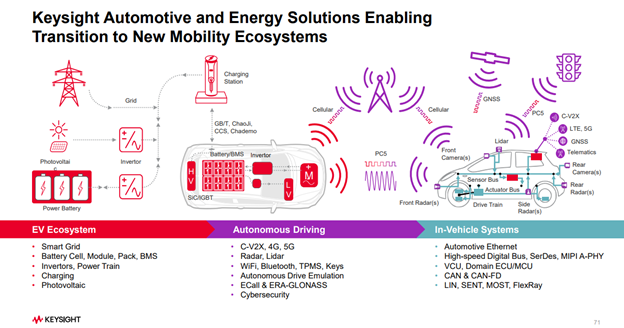

Even before the ESI acquisition, Keysight benefited from several secular tailwinds in Automotive. Like many of their peers (and customers) the increasing silicon content from advanced safety features and electrification are meaningful tailwinds.

Section 5: Comments on management, the balance sheet and capital allocation.

I am going to keep this short, but one of the things I find attractive about KEYS is that they seem to be led by a rational management team, that has aligned compensation, a conservative balance sheet and thoughtful capital allocation plan.

Satish Dhanasekaran took over from Ron in May of 2022 after a brief stint as COO and a nearly 20-year history with the company primarily in the communication space where he helped to spear head their victories in 5g. Thus far I have found him to be thoughtful and knowledgeable about the competitive vectors that Keysight is pursuing. Importantly, he is backed by CFO Neil Dougherty who also has a long history with the company and was the CFO who led Keysight through the split with Agilent and would help craft the revitalization plan that is still in place today. While this is not an owner operator led company with insiders holding a large stake in the company, their compensation structure is very shareholder friendly. I particularly like the LTIP’s inclusion of relative TSR vs. the S&P 500, the STIP EPS and ARR focus (although the ESG inclusion is something I could do without).

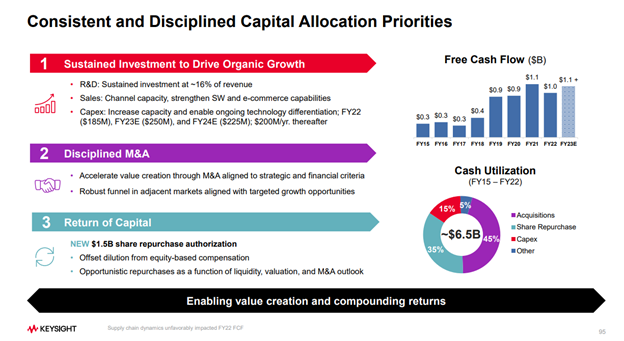

Management targets 2x gross debt to EBITDA but has run significantly below that for some time. Part of the reason for this is that their preferred software acquisitions have been hard to come by with elevated valuations. ESI did address this and was bought with cash on hand that was a little less than a full years FCF. When they are not making acquisitions, I expect them to be buying back shares and they have a history of shrinking the share count in excess of dilution (apart from when they have used stock to make acquisitions).

On acquisitions, KEYS history here is quite productive. They tend not to be bargain hunters of any sort, but rather have been pretty good at peaking around corners to see where the puck is going. Anite was crucial to securing their software lead in communications right before the 5g wave and Ixia helped reinforce their networking chops a few years before it became clear that networking was to become one of the major technical bottlenecks for high-speed computing. Smaller acquisitions like Eggplant and Cliosoft were nice expansions into the application layer that is typically a higher value add for customers. One could argue that they made the Ixia acquisition at the top of a networking cycle, but as you stretch out the time horizon it certainly appears to me that it worked out. If management is successful in continuing to push the business mix towards software, I suspect that we might see a sustained lift in multiples like what we have seen occur in other industrial technology companies like DHR, ROP, or ROK.

Section 6: A mental model for valuation

Occasionally, there comes an opportunity to invest in a company that is seemingly at the center of multiple secular growth drivers. Typically, the market has recognized the opportunity, and it is rare to find these businesses trading at attractive prices. In fact, the skill for most investors is finding these companies and pouncing on them when there is a cyclical drawdown, macro shock or malaise in sentiment. The hard part of course being differentiating between the end of secular growth and a cyclical event. Not to mention the fact that most of the rewards are reaped by stepping into a name while the drawdown is still happening…making being too early the difference between a timing error and poor fundamental analysis.

One thing for Keysight is clear, we have entered the cyclical drawdown. Street estimates for revenue and EPS have been appropriately calibrated downwards all year.

While it is hard to know for sure if we have truly bottomed out, and a rough macro could upset the timing of a recovery, my sense is that the secular drivers are intact enough that we should see a bottom in the earnings profile this year. Before the late 2023 rally KEYS was trading sub $130. This might have looked like a very favorable skew for long term holders. 20x depressed earnings for a business with this many secular drivers, substantial interlocking competitive advantages, an enviable margin profile, attractive returns on capital and through cycle EPS growth profile of 10% without accounting for capital allocation seems like a win.

It is possible to envision a true trough and trough pricing for KEYS that sends the stock closer to $100 (~$6 @16x) but it is hard for me to see the business trading there for a long period of time. A possible scenario like this would entail further degradation in communications revenue below 2019 levels, a double-digit decline in organic EISG revenues and 450 bps of margin compression. This would be among the worst cycles for the company outside of the GFC and seems like a low probability event given how much the mix the business has changed. In fact, if an investor got comfortable enough with issues being truly cyclical and not structural, then that sort of pricing might allow one to really back up the truck on the name.

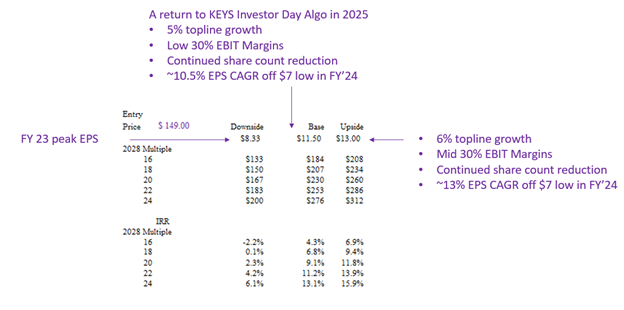

While I am not one to blindly trust management’s guidance, it is notable that KEYS has largely outperformed their prior guidance levels over time. I could see this year’s ~$7 EPS as the low point for earnings. Compound that at 10%, shrink the float a little bit every year and it’s not hard to get to $11.50 of EPS in 5 years. Push the capital allocation levers more aggressively or better end market demand and perhaps $13+ is in sight over the medium term. This is closer to the rate that EPS has compounded from 2016 through 2024 estimates. From today’s prices you need to maintain a mid-20’s multiple for the name to be attractive. Perhaps that is not crazy if you think the software and services mix continues to grow.

Conclusion: Core Thesis

Keysight is a mildly cyclical, but excellent business supported by process power, switching cost, scale, and branding moats. The margin profile of the business is exceptional with mid 60%+ gross margins, 40% incremental margins, and an ability to dent decremental margins in a downturn. It is hard not to be attracted to a business that plays such a vital role in the industry and is likely to be very cash generative even in a rough macro environment. Their end markets and revenue drivers are backed by several secular tailwinds around wireless communication, advanced networking, and greater degrees of electrification/digitization of our lives. This supports a long runway of reinvestment opportunities, both from organic R&D as they remain ‘first’ to market with key technology enablers and an M&A playbook focused on a fragmented competitive set. The increasing software and services mix and exposure to research and design end markets should lower the volatility of Keysight earnings stream, increase the margin profile and continue to garner Keysight a premium valuation.

Disclosure: At the time of writing, accounts associated with the author owned shares of KEYS, ANET, ADI, GOOG, META, & AMZN. The author may have bought, sold or exited any of the companies mentioned in this post without notice.